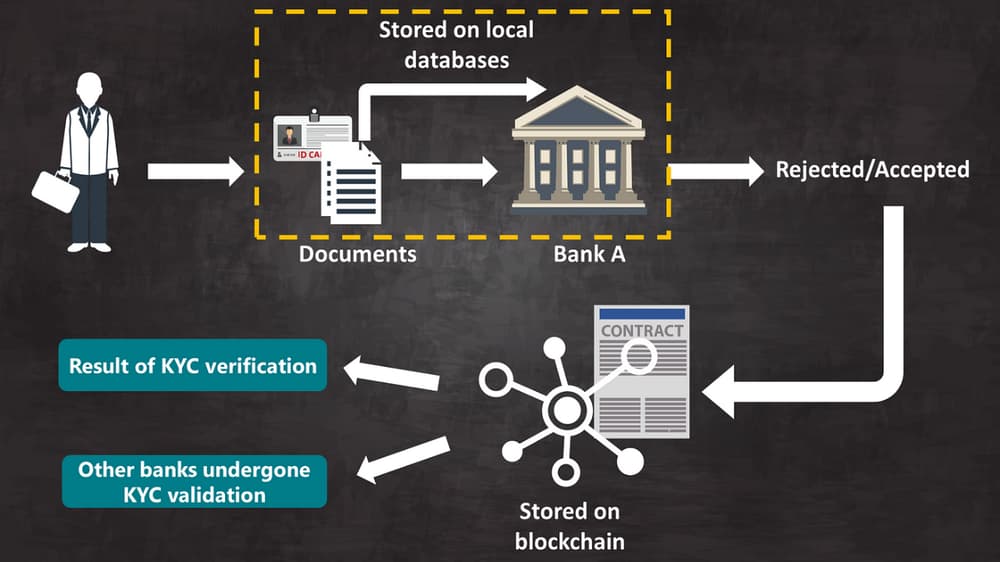

Blockchain technology is revolutionizing KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance by offering a shared, tamper-proof ledger for secure and efficient identity verification. Instead of duplicating efforts across institutions, verified customer data can be reused with permission, reducing costs, speeding up onboarding, and improving security

Blockchain for KYC & AML Compliance A Shared Ledger Approach

Written by Sumit Kaushik

In an age of increasing regulatory oversight and cyber attacks, banks and financial institutions find themselves under increasing pressure to comply with Know Your Customer (KYC) and Anti-Money Laundering (AML) regulation.

Current methods of compliance are inefficient, isolated, and time-consuming. Solution: blockchain technology—with the promise of greater efficiency, security, and transparency to the KYC and AML process.

What Is Blockchain

In essence, blockchain is a tamper-evident, decentralized digital book of records that stores transactions on multiple computers. Because data cannot be altered once entered, its immutability makes it the best option for applications that involve transparency and trust—regulatory compliance, for example.

KYC and AML: The Compliance Challenge

Know Your Customer (KYC

KYC procedures mandate institutions to authenticate the identity of their customers by gathering and confirming documents such as passports, bills, and statements.

Anti-Money Laundering (AML)

AML entails transaction monitoring and behavior watchlist monitoring for suspicious activity that may reveal money laundering, terror funding, or fraud.

Such compliance processes are usually most commonly siloed between institutions, given that they are redundant and subject to human error—resulting in higher operational expense and longer delays.

Blockchain's Role in KYC/AML

- A Decentralized Authenticated Ledger of Identity: Blockchain enables a single, verified customer identity to be held on a decentralized network. Once information on a customer has been verified by an institution, other holders of permissions can use it securely—avoiding duplication.

- Inalterability of KYC Documents: All KYC documents uploaded onto the blockchain are dated and irreversible. This provides an open audit trail which is easy for regulators to verify.

- Instantaneous Monitoring of Transactions: Smart contracts written on the blockchain can be designed to identify suspicious transactions in real-time, increasing the efficiency of AML. They can be made to include AML policies that can freeze funds or raise alarms.

- Customer-Controlled Data: Blockchain allows for self-sovereign identity where customers hold custody of their data and allow selective disclosure to institutions. This preserves maximum privacy but remains compliant.

Advantage of Blockchain-Based KYC/AML

- Cost Savings: Eliminates KYC replication across institutions, saving onboarding expenses.

- Speed: Accelerates onboarding through expedited identity verification and document validation.

- Security: Prevents risk of data loss through cryptography protection.

- Transparency: Offers regulators real-time insight into compliance information.

- Interoperability: Facilitates smooth exchange of compliance information among banks, fintechs, and regulators.

Real-World Applications

HSBC and ING are testing blockchain-based KYC systems to facilitate global trade finance.

Dubai International Financial Centre (DIFC) released a blockchain-based KYC platform for efficient client onboarding across the UAE.

R3's Corda, a blockchain consortium, is piloted for KYC sharing across banks.

⚠️ Challenges & Considerations

Data Privacy Regulation: Blockchain immutability contradicts laws such as GDPR, which necessitates the delivery of erasability of user information.

- Standardization: In the absence of international standards, interoperability across various blockchain systems could be affected.

- Onboarding Trust: Institutions need to trust the first validator of a customer's KYC details in order to reuse it.

- Regulatory Uncertainty: Shifting legislation concerning blockchain and crypto may affect adoption.

The Future of Blockchain and Compliance

With blockchain maturing and going more mainstream, its use in regulatory technology (RegTech) will be progressively deeper. We are heading towards a compliant model that is cooperative—one where regulators, banks, and customers all reside within an open, streamlined environment facilitated by blockchain.

Technologies such as Zero-Knowledge Proofs (ZKPs) and privacy-preserving blockchains will soon see their regulatory issue of data visibility addressed, rendering blockchain a utility but the future backbone for AML and KYC compliance.

Final Thoughts

Blockchain for AML and KYC is not a technology innovation—it's a new model for trusting, complying, and getting to know one another in the digital money universe. Employing a shared ledger architecture, banks can minimize costs, maximize security, and enhance the customer experience, all in harmony with regulation.

As finance becomes more interconnected around the world, doing it with blockchain for compliance is not just clever—it's unavoidable.