Glocal Payment Orchestration enables global merchants to offer localized payment options tailored to each market, boosting conversion rates and ensuring compliance. Companies like Stripe and Payoneer are leading this trend by integrating multiple regional payment methods into a single platform.

Glocal Payment Orchestration: The Secret Sauce Behind Seamless Global E-commerce

Written by Kashish Rajput

E-commerce in 2025 is borderless—but payments aren't. That is where Glocal Payment Orchestration comes in, enabling global businesses to accept localized payments wherever they are.

Whether São Paulo shopper is paying through Pix, a German consumer paying with Klarna, or an Indian buyer paying through UPI—one-size-fits-all isn't possible. Today's global-first businesses are facing: if you're aspiring for global reach, you require local depth.

What is Glocal Payment Orchestration?

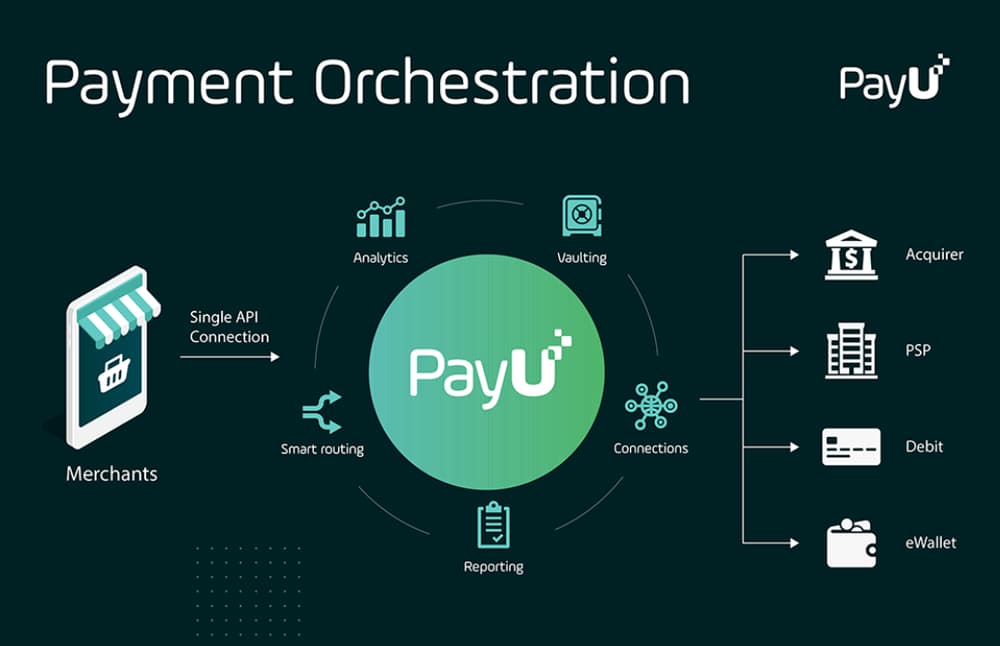

Glocal Payment Orchestration is the combination of global infrastructure and local payment behavior. Multiple local payment modes—cards, wallets, bank transfers, BNPL, etc.—can be provided by merchants without multiple integrations.

Imagine it as a "universal payment layer":

Integrate once → access to hundreds of localized payment methods

Route payments intelligently for higher approval rates

Centralize compliance, FX, risk, and reconciliation in a single solution

Who's Leading the Charge?

- Stripe: Stripe Payment Element & Connect now processes more than 135 currencies and dozens of payment methods, including iDEAL (Netherlands), GrabPay (SE Asia), and Affirm (US BNPL). Its orchestration engine smart-routes by geography, currency, and device behavior.

- Payoneer: Popular among freelance workers and B2B vendors, Payoneer allows customers to receive payments locally and globally in local currency, in more than 200 countries. They partnered with banks, wallets, and fintech rails to enhance cross-border experience.

- Adyen, Checkout.com, Rapyd: These operators are also investing in smart orchestration, which allows A/B testing of payment channels, real-time currency conversion, and region-specific adaptive risk logic.

Why It Matters: The ROI of Going "Glocal"

- Improved Conversion Rates: 70% higher chance of customers completing a purchase if they view familiar, recognized payment methods.

- Rules Compliance: Regional payment rules are varied—GDPR in Europe, UPI rules in India, KYC processes in UAE. Orchestration engines enable this complicated setup so merchants don't fall foul of the rules.

- Less Cart Abandonment: Cart drop-offs happen most frequently at payment. Providing local choices like Paytm in India or iDEAL in Netherlands decreases friction by a great deal.

- Smarter Routing = Lower Fees: Routing high-ticket transactions through low-fee local partners lowers interchange fees and declined payments.

Real-World Examples

A U.S. SaaS business can charge Japanese consumers through Konbini or Brazilian consumers through Boleto Bancário, without having to write a single line of code for each.

A German e-tailer selling in India can provide UPI, RuPay, and Paytm, auto-translated in local currency and language.

How It Works: A Flow Simplified

- Customer chooses item → goes to checkout

- Orchestration engine recognizes location, device, and currency

- Shows localized choices: e.g., GPay, Klarna, Afterpay

- Customer makes one-click purchase

- Merchant gets paid in home currency, compliance taken care of

The Future of Glocal FinTech

With remote work, SaaS, and glocal payment orchestration leading the way globally, digital nomads are also becoming increasingly common. Look out for:

- AI-powered dynamic checkout pages tailored to every shopper

- Cross-border BNPL & cryptocurrency payments

- Single reconciliation dashboard for FX, tax, and fraud

Conclusion: Think Global, Pay Local

As companies become digital on continents, it is no longer a choice but an imperative to "think global but pay local." Today's customers expect seamless, familiar, and fast payment experiences, irrespective of where a merchant operates. That is what exactly Glocal Payment Orchestration offers.

By combining global reach with local context, it enables businesses to pilot new markets without being overwhelmed by integrations, regulatory issues, or cart abandonment. Rather than forcing one-size-fits-all solutions, platforms such as Stripe, Payoneer, and Adyen are enabling businesses to set up their infrastructure for every shopper's individual needs—from the currency they prefer to the payment method they habitually use.

In addition to convenience, this orchestration releases huge financial and strategic value:

- Higher checkout conversion rates

- Reduced failure rates and transaction costs

- Seamless compliance with local legislation

- Quick time-to-market in new regions

And puts merchants in a position to look forward to the next payments innovation—be it AI-optimized checkouts, blockchain settlements, or real-time cross-border BNPL.

In an hyper-connected economy where the routine sticks but borders disintegrate, Glocal Payment Orchestration is not merely a technology trend—it's a business necessity. It closes the loop between merchant capability and customer expectation, allowing brands to win hearts, boost profitability, and establish enduring global presence—local payment by local payment.