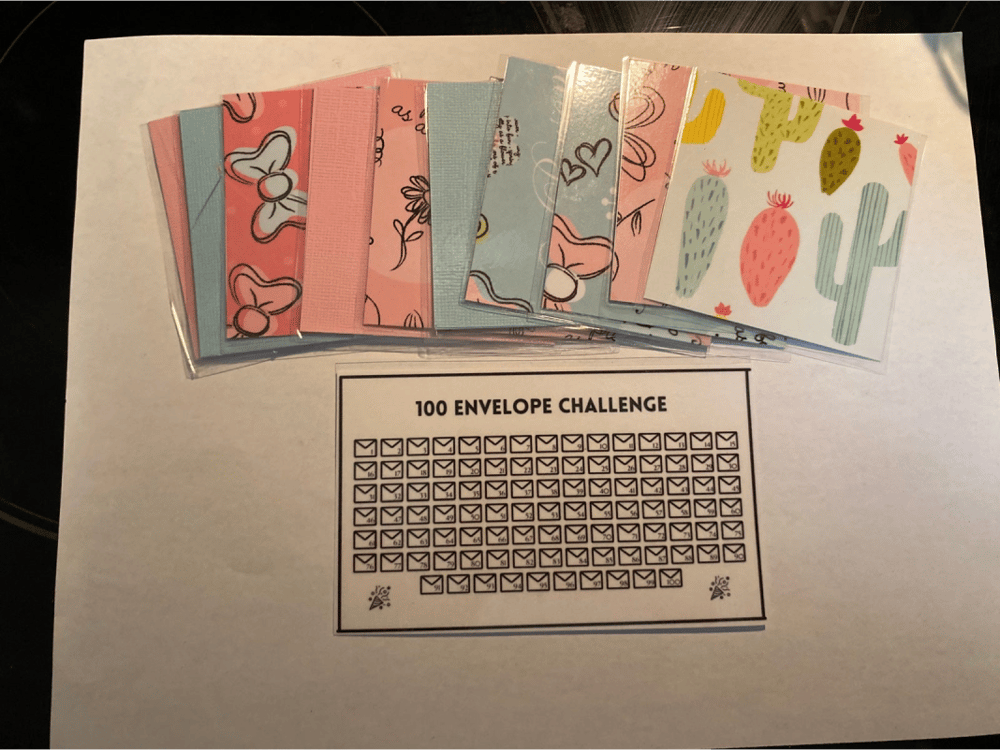

The 100 Envelope Challenge has taken TikTok by storm as a fun and visual way to build a serious savings habit. By randomly picking and filling envelopes numbered 1–100 with corresponding amounts, users can save a substantial amount in a relatively short time

At a moment when anything can be had in an instant on the touch of a button, living frugally has never been so challenging—especially for young adults these days with growing cost of living, student loans, and social media-influenced lifestyles. In the utter chaos in which the world is at this moment, the 100 Envelope Challenge has arrived not just as a belly-laughing TikTok meme, but as a neat money good habit-forming blueprint.

Made viral on #MoneyTok, the humble savings challenge has racked up millions of views as users share jars of money stacked in stacks of envelopes, visual trackers, and motivational check-ins. Why so much fixation, then? More importantly—is the 100 Envelope Challenge real, or merely a beauty hoax?

Let's cut through the math, the logic, the psychology—and discover whether the 100 Envelope Challenge is worth your time.

Stay updated with expert insights, money tips, and financial trends—explore our Latest Finance News section.

What is the 100 Envelope Challenge?

The concept is quite simple and very handy. Here's what you do:

Number 100 envelopes from 1 to 100.

Draw one envelope at random every day (or alternate days).

Deposit the amount of money as the number inscribed in it instructs you to. If you pick envelope #47, for example, you put ₹47/$47 in it.

Continue doing it till all 100 envelopes are filled.

Saved money = 1 + 2 + 3 +. + 100 = ₹5,050 / $5,050 more than 3 months.

It's simply an algebra problem:

Sum = n(n+1)/2 → 100 × 101 ÷ 2 = 5050

Why It Caught On: The Psychology of the Trend

The puzzle is a success not simply because it is well-formed mathematically—but because it is based upon behaviorist psychology and habit formation

- Visual Motivation: Seeing envelopes fill with money gives an immediate sense of achievement.

- Gamification: Surprise envelope selection brings delight and joy.

- Small Wins = Big Confidence: Saving only ₹5 or ₹10 boosts confidence.

- Social Accountability: Posting updates on TikTok/Instagram builds an encouragement community and social proof.

Benefits of the 100 Envelope Challenge

- Builds Discipline: Having a very small money decision every day builds habits over time. Micro-commitment = macro productivity.

- Stops Lifestyle Inflation: As your income grows, you’re still locked into a routine of saving consciously, rather than increasing spending with every raise.

- Perfect for Short-Term Goals: Whether you’re planning a trip, buying a new gadget, or building an emergency fund—₹5,000 can go a long way in 100 days.

- Encourages Cash Awareness: With UPI and cards, many forget the value of physical cash. This challenge brings it back—tangibly.

Realistic Mistakes & How to Bail Out

- Not Appropriate for the Digitally-Inclued: Maybe it's just not feasible for all of us to carry and have cash in our hands. Solution: Use spending apps like YNAB, Goodbudget, or even Notion/Excel.

- Imbalanced Financial Days: It hurts to dip into envelope #95 on a lean day. Solution: Follow the "Reverse 50/50 Rule"—choose one high-numbered and one low-numbered envelope per week.

- Urge to Raid: Having money in hand at home is risky when you lack willpower. Solution: Tape envelopes shut or request someone responsible/reliable to carry them along with them.

- Lost Days = Broken Continuity: It's hard to catch up when you fall behind. Solution: Add a weekly check-up and include buffer days.

Changes to Make It Work for You

The 50 Envelope Challenge: Halve it to save ₹1,275 instead.

The Digital Envelope Challenge: Make 100 digital envelopes on a mobile application.

The Couple's Challenge: Save together with a partner.

The Kids' Version: Begin at ₹30 to ₹1 for school children to learn to save.

Why It's a Hit on TikTok

Humans are attracted to tangible visual progress—and this challenge delivers it. Trendy videos include envelope boxes, progress charts, and countdowns, all of which are dopamine inducers. The trend is not saving—it's revealing a money change.

Even influencers save personal by giving each envelope a purpose:

#10 = "Movie Night"

#75 = "New Phone Fund"

#100 = "Goa Trip"

The emotional connection process makes saving story-based.

Math Behind The Magic

| Envelope Range | Total Saved |

|---|---|

| 1–25 | ₹325 |

| 1–50 | ₹1,275 |

| 1–75 | ₹2,850 |

| 1–100 | ₹5,050 |

Even breaking even gives you a giant buffer for surprise costs or short-term savings objectives.

Who Should Try It?

- Young adults with terrible saving habits

- Students learning the money discipline

- Couples saving for a shared goal (wedding, vacation, rent)

Anyone in need of a kick-start without needing to learn detailed budgeting strategies

The Verdict: Does It Really Work?

Yes, if only you remain consistent.

The 100 Envelope Challenge isn’t a magic trick—but a psychological hack that blends habit, fun, visuals, and rewards.

It turns the abstract act of saving into a daily concrete win.

If you’re tired of budgeting apps that don’t excite you, or goals that feel too far away, this challenge can be your starting point. Think of it as a fitness challenge—but for your wallet.