Rehypothecation in DeFi refers to the reuse of collateral across multiple protocols to maximize liquidity and yield. While it enhances capital efficiency, it also introduces systemic risks, including cascading liquidations, smart contract vulnerabilities, and liquidity mismatches. Real-world cases like the Terra-Luna collapse and stETH depegging highlight its dangers.

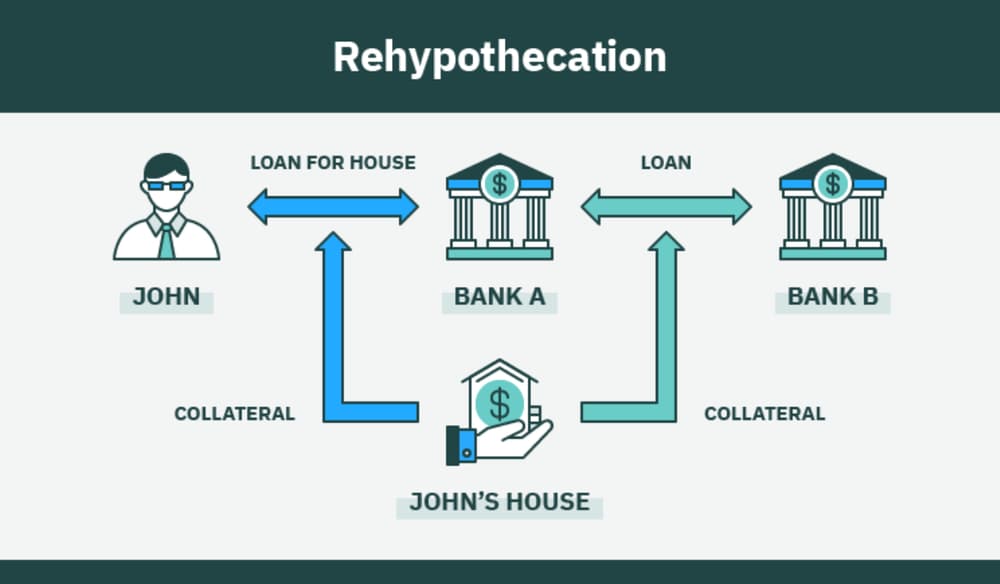

Rehypothecation may be jargon finance Wall Street lingo, but it is the problem of decentralized finance (DeFi) these days. Traditionally, rehypothecation is a bank double-use of customers' collateral that they have deposited (most of the time unwittingly) and utilizes it to satisfy its own lending. It has the potential to unleash the squeeze—leveraging maximum liquidity—but also carries systemic risk, as during the 2008 crisis.

In DeFi, a world of transparency, decentralization, and self-custody, rehypothecation exists behind a veil of mystery. Can it occur in trustless, smart-contract-based universes? If yes, what are the consequences for users, protocols, and financial stability?

This article discusses the dangers, realities, and inherent traditions of rehypothecation in DeFi, in contrast to TradFi (traditional finance) and whether rehypothecation is a liquidity requirement or waiting time bomb.

Rehypothecation in TradFi vs. DeFi

| Aspect | TradFi | DeFi |

|---|---|---|

| Custody | Banks and brokers hold client assets | Users maintain custody via wallets (initially) |

| Transparency | Low – often buried in contracts | High – on-chain, but often complex mechanisms |

| Use of Collateral | Reused by banks for their own leverage | Protocols can loop and reuse collateral |

| User Awareness | Limited | Varies – requires deep knowledge of protocols |

In DeFi, rehypothecation would normally be recursive borrowing. In other words, users can:

Deposit collateral in Aave, take out a stablecoin loan, and deposit it in another protocol like Compound, etc.

Or protocols themselves may rehypothecate user-deposited assets to farm yield, mine liquidity, or stake on chains or platforms.

This is not exactly the same form of rehypothecation in TradFi, but the effect is the same: multiple claims on the same collateral.

Why Rehypothecation Occurs in DeFi

- Maximizing Yield: Capital efficiency is the game of DeFi. Protocols continually attempt to maximize yield by rehypothecating across platforms.

- Boosting Liquidity: When protocols rehypothecate, liquidity in lending and borrowing is amplified.

- Composability ("Money Legos"): Interoperability is what DeFi is all about. Rehypothecation is the unexpected side effect of nesting protocols on top of one another.

User Strategies

Yield farmers will typically use recursive techniques to recurse leverage, doubling returns and also risk.

The Risks: Where Things Can Go Wrong

- Systemic Leverage: The most significant threat is that different protocols may rely on the same collateral. Price shock (e.g., stablecoin depeg or crypto collapse) would trigger world-wide liquidations, which in turn would create a cascade effect across platforms.

- Smart Contract Risk: The attack surface increases with more protocols added. A bug, hack, or oracle manipulation at one location can be propagated to the entire system.

- User Confusion & Hidden Exposure: Few realize that their holdings can be rehypothecated. While the conditions of unknown banks are opaque, however, the DeFi technology can serve as an invisible risk layer.

- Liquidity Mismatch: When everyone asks for their funds at the same time (a run on a bank in digital form), protocols will have none to offer, particularly if assets are staked or locked in some other location.

- Regulatory Scrutiny: If DeFi goes the more risky TradFi way, it is to be expected to be governed by the same rules. Opaque or transparent, regulators will act if there is retail user risk involved.

Examples in Real Life in DeFi

Terra-Luna Collapse (2022)

UST was over-staked and recycled, including on Anchor Protocol.

Yield illusion and liquidity built a flimsy ecosystem.

When the peg broke, there was a cascading liquidation and asset blowup.

StETH Depegging

Lido's staked ETH (stETH) was over-rehypothecated.

When liquidity in Curve dried up and stETH was trading at discounts to ETH, exposure holders and protocols were high and dry.

The Flip Side: Can Rehypothecation Be Good?

✅ Yes, if rehypothecation is done openly and with risk management.

Rehypothecation can:

Improve capital efficiency

Enable protocol growth

Smooth liquidity across chains

But only if rehypothecation is done in an open manner, supported by healthy liquidation mechanisms, and prudent risk modeling.

The Future: Navigating Rehypothecation in a Safer DeFi

- Collateral Tracking Tools: Third-party dashboards and standards can track collateral flows such that users can see where and how exactly their assets get recycled.

- Dynamic Risk Models: Rather than hardcoded collateral ratios, more intelligent systems would dynamically adapt demands as a function of network leverage metrics.

- Segregated Collateral Pools: Certain protocols now provide opt-in rehypothecation, such that users can toggle between higher yields or secure, segregated vaults.

- Audit-Driven Transparency: Regular on-chain checking and real-time dashboards can uncover hidden risks.

Comittment: Two-Edged Sword

Rehypothecation DeFi is neither inherently good nor bad—it is a tool. All tools do have the ability to build or demolish, however, and that remains in the user's hand.

As DeFi matures, the industry must balance innovation with caution, ensuring that the pursuit of yield doesn’t replicate the very risks DeFi was built to eliminate. Whether you’re a builder, investor, or user, understanding how collateral flows through this ecosystem is crucial to staying ahead—and staying safe.