FinTech News News

Fintech in Space: How Satellite Data Is Being Used for Financial Risk Assessment and Insurance

Fintech in space is revolutionizing financial risk assessment and insurance by using satellite data to deliver real-time insights. From assessing crop health for agricultural loans to speeding up disaster insurance payouts and monitoring supply chains, space tech offers unmatched precision and efficiency.

3 minute read

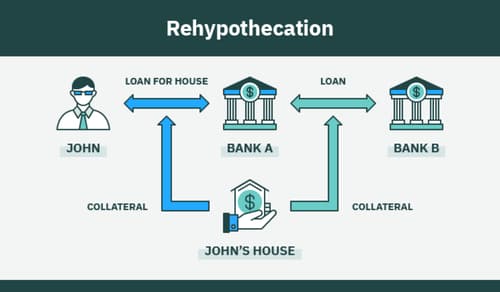

Rehypothecation in DeFi: Risks and Realities

Rehypothecation in DeFi refers to the reuse of collateral across multiple protocols to maximize liquidity and yield. While it enhances capital efficiency, it also introduces systemic risks, including cascading liquidations, smart contract vulnerabilities, and liquidity mismatches. Real-world cases like the Terra-Luna collapse and stETH depegging highlight its dangers.

4 minute read

Biometric Payment Cards: The Future of Contactless with Fingerprint Security

Biometric payment cards combine fingerprint recognition with contactless payment technology to offer enhanced security and convenience. By verifying transactions through unique biometric data stored securely on the card, these cards reduce fraud risk and eliminate the need for PINs.

4 minute read

Neurofinance: Leveraging Brain-Computer Interfaces (BCI) for Financial Decision-Making

Neurofinance: Harnessing Brain-Computer Interfaces (BCI) to Revolutionize Financial Decisions explores how emerging BCI technology can directly read brain activity to enhance and personalize financial decision-making. By detecting real-time emotions, cognitive biases, and mental states.

4 minute read

Time as Currency: Can You Lend Minutes Instead of Money?

Time banking is a revolutionary FinTech concept where people trade hours of service instead of money, fostering financial inclusion—especially in underbanked communities. Platforms enable users to earn time credits by offering skills or help, which they can then spend on other services.

4 minute read

The FinTech of Death: Digital Wills, NFT Heirlooms & Posthumous Payments

FinTech is transforming how we handle digital legacies with innovations like automated digital wills, NFT-based heirlooms, and scheduled posthumous payments.

4 minute read

BNPL 3.0 – What’s Next? Responsible Lending, Regulation, and the Rise of B2B BNPL

BNPL 3.0 marks the next evolution of Buy Now, Pay Later, focusing on responsible lending, regulatory compliance, and the rise of B2B BNPL. As concerns about consumer debt and transparency grow, BNPL platforms are adopting smarter credit checks, financial literacy tools, and AI-powered risk assessments.

4 minute read

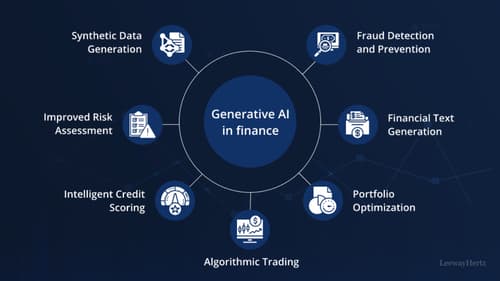

Synthetic Data in Fintech Enhancing Data Privacy and Training AI Models Without Compromising Real User Data

Synthetic data is revolutionizing the fintech industry by enabling the safe development of AI models without using real user data. It mimics real financial data while preserving privacy, making it ideal for training AI, testing products, and ensuring regulatory compliance.

4 minute read

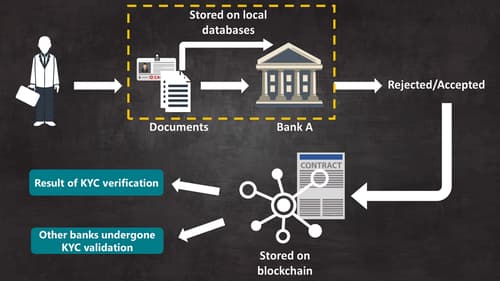

Blockchain for KYC & AML Compliance A Shared Ledger Approach

Blockchain technology is revolutionizing KYC (Know Your Customer) and AML (Anti-Money Laundering) compliance by offering a shared, tamper-proof ledger for secure and efficient identity verification. Instead of duplicating efforts across institutions, verified customer data can be reused with permission, reducing costs, speeding up onboarding, and improving security

3 minute read